November 22, 2022

by Medeea Greere | AMG News

Executive Order 1110 gave the US the ability to create its own money backed by silver.…

On June 4, 1963, a little known attempt was made to strip the Federal Reserve Bank of its power to loan money to the government at interest. On that day President John F. Kennedy signed Executive Order No. 11110 that returned to the U.S. government the power to issue currency, without going through the Federal Reserve. Mr. Kennedy’s order gave the Treasury the power “to issue silver certificates against any silver bullion, silver, or standard silver dollars in the Treasury.”

This meant that for every ounce of silver in the U.S. Treasury’s vault, the government could introduce new money into circulation. In all, Kennedy brought nearly $4.3 billion in U.S. notes into circulation. The ramifications of this bill are enormous.

With the stroke of a pen, Mr. Kennedy was on his way to putting the Federal Reserve Bank of New York out of business. If enough of these silver certificates were to come into circulation they would have eliminated the demand for Federal Reserve notes. This is because the silver certificates are backed by silver and the Federal Reserve notes are not backed by anything.

Executive Order 11110 could have prevented the national debt from reaching its current level, because it would have given the government the ability to repay its debt without going to the Federal Reserve and being charged interest in order to create the new money. Executive Order 11110 gave the U.S. the ability to create its own money backed by silver.

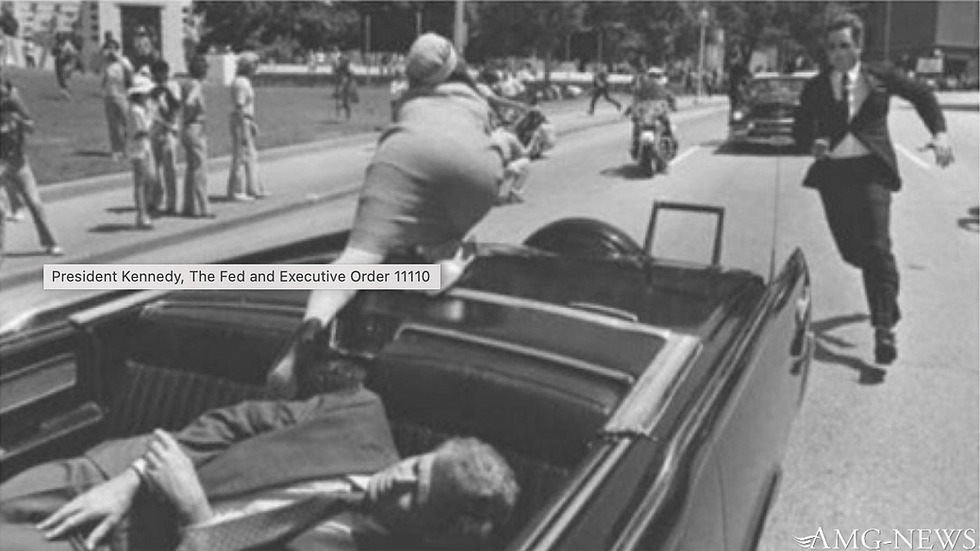

After Mr. Kennedy was assassinated just five months later, no more silver certificates were issued. The Final Call has learned that the Executive Order was never repealed by any U.S. President through an Executive Order and is still valid. Why then has no president utilized it? Virtually all of the nearly $6 trillion in debt has been created since 1963, and if a U.S. president had utilized Executive Order 11110 the debt would be nowhere near the current level.

Perhaps the assassination of JFK was a warning to future presidents who would think to eliminate the U.S. debt by eliminating the Federal Reserve’s control over the creation of money.

Mr. Kennedy challenged the government of money by challenging the two most successful vehicles that have ever been used to drive up debt – war and the creation of money by a privately-owned central bank. His efforts to have all troops out of Vietnam by 1965 and Executive Order 11110 would have severely cut into the profits and control of the New York banking establishment. As America’s debt reaches unbearable levels and a conflict emerges in Bosnia that will further increase America’s debt, one is force to ask, will President Clinton have the courage to consider utilizing Executive Order 11110 and, if so, is he willing to pay the ultimate price for doing so?

--

Executive Order 11110 AMENDMENT OF EXECUTIVE ORDER NO. 10289

AS AMENDED, RELATING TO THE PERFORMANCE OF CERTAIN FUNCTIONS AFFECTING THE DEPARTMENT OF THE TREASURY

By virtue of the authority vested in me by section 301 of title 3 of the United States Code, it is ordered as follows:

Section 1. Executive Order No. 10289 of September 19, 1951, as amended, is hereby further amended-

By adding at the end of paragraph 1 thereof the following subparagraph (j):

(j) The authority vested in the President by paragraph (b) of section 43 of the Act of May 12,1933, as amended (31 U.S.C.821(b)), to issue silver certificates against any silver bullion, silver, or standard silver dollars in the Treasury not then held for redemption of any outstanding silver certificates, to prescribe the denomination of such silver certificates, and to coin standard silver dollars and subsidiary silver currency for their redemption

and —

By revoking subparagraphs (b) and (c) of paragraph 2 thereof.

Sec. 2. The amendments made by this Order shall not affect any act done, or any right accruing or accrued or any suit or proceeding had or commenced in any civil or criminal cause prior to the date of this Order but all such liabilities shall continue and may be enforced as if said amendments had not been made.

John F. Kennedy The White House, June 4, 1963.

--

Of course, the fact that both JFK and Lincoln met the the same end is a mere coincidence.

Abraham Lincoln’s Monetary Policy, 1865 (Page 91 of Senate document 23.)

Money is the creature of law and the creation of the original issue of money should be maintained as the exclusive monopoly of national Government.

Money possesses no value to the State other than that given to it by circulation.

Capital has its proper place and is entitled to every protection. The wages of men should be recognized in the structure of and in the social order as more important than the wages of money.

No duty is more imperative for the Government than the duty it owes the People to furnish them with a sound and uniform currency, and of regulating the circulation of the medium of exchange so that labour will be protected from a vicious currency, and commerce will be facilitated by cheap and safe exchanges.

The available supply of Gold and Silver being wholly inadequate to permit the issuance of coins of intrinsic value or paper currency convertible into coin in the volume required to serve the needs of the People, some other basis for the issue of currency must be developed, and some means other than that of convertibility into coin must be developed to prevent undue fluctuation in the value of paper currency or any other substitute for money of intrinsic value that may come into use.

The monetary needs of increasing numbers of People advancing towards higher standards of living can and should be met by the Government. Such needs can be served by the issue of National Currency and Credit through the operation of a National Banking system.

The circulation of a medium of exchange issued and backed by the Government can be properly regulated and redundancy of issue avoided by withdrawing from circulation such amounts as may be necessary by Taxation, Redeposit, and otherwise. Government has the power to regulate the currency and credit of the Nation.

Government should stand behind its currency and credit and the Bank deposits of the Nation. No individual should suffer a loss of money through depreciation or inflated currency or Bank bankruptcy.

Government possessing the power to create and issue currency and credits money and enjoying the right to withdraw both currency and credit from circulation by Taxation and otherwise need not and should not borrow capital at interest as a means of financing Governmental work and public enterprise. The Government should create, issue, and circulate all the currency and credit needed to satisfy the spending power of the Government and the buying power of the consumers. The privilege of creating and issuing money is not only the supreme prerogative of Government, but it is the Governments greatest creative opportunity.

By the adoption of these principles the long felt want for a uniform medium will be satisfied. The taxpayers will be saved immense sums of interest, discounts, and exchanges. The financing of all public enterprise, the maintenance of stable Government and ordered progress, and the conduct of the Treasury will become matters of practical administration. The people can and will be furnished with a currency as safe as their own Government. Money will cease to be master and become the servant of humanity. Democracy will rise superior to the money power.

Some information on the Federal Reserve The Federal Reserve, a Private Corporation One of the most common concerns among people who engage in any effort to reduce their taxes is, “Will keeping my money hurt the government’s ability to pay it’s bills?”

As explained in the first article in this series, the modern withholding tax does not, and wasn’t designed to, pay for government services. What it does do, is pay for the privately-owned Federal Reserve System.

Black’s Law Dictionary defines the “Federal Reserve System” as, “Network of twelve central banks to which most national banks belong and to which state chartered banks may belong. Membership rules require investment of stock and minimum reserves.”

Privately-owned banks own the stock of the Fed. This was explained in more detail in the case of Lewis v. United States, Federal Reporter, 2nd Series, Vol. 680, Pages 1239, 1241 (1982), where the court said:

Each Federal Reserve Bank is a separate corporation owned by commercial banks in its region. The stock-holding commercial banks elect two thirds of each Bank’s nine member board of directors.

Similarly, the Federal Reserve Banks, though heavily regulated, are locally controlled by their member banks. Taking another look at Black’s Law Dictionary, we find that these privately owned banks actually issue money:

Federal Reserve Act. Law which created Federal Reserve banks which act as agents in maintaining money reserves, issuing money in the form of bank notes, lending money to banks, and supervising banks. Administered by Federal Reserve Board (q.v.).

The FED banks, which are privately owned, actually issue, that is, create, the money we use. In 1964 the House Committee on Banking and Currency, Subcommittee on Domestic Finance, at the second session of the 88th Congress, put out a study entitled Money Facts which contains a good description of what the FED is:

The Federal Reserve is a total money-making machine.It can issue money or checks. And it never has a problem of making its checks good because it can obtain the $5 and $10 bills necessary to cover its check simply by asking the Treasury Department’s Bureau of Engraving to print them.

Comments