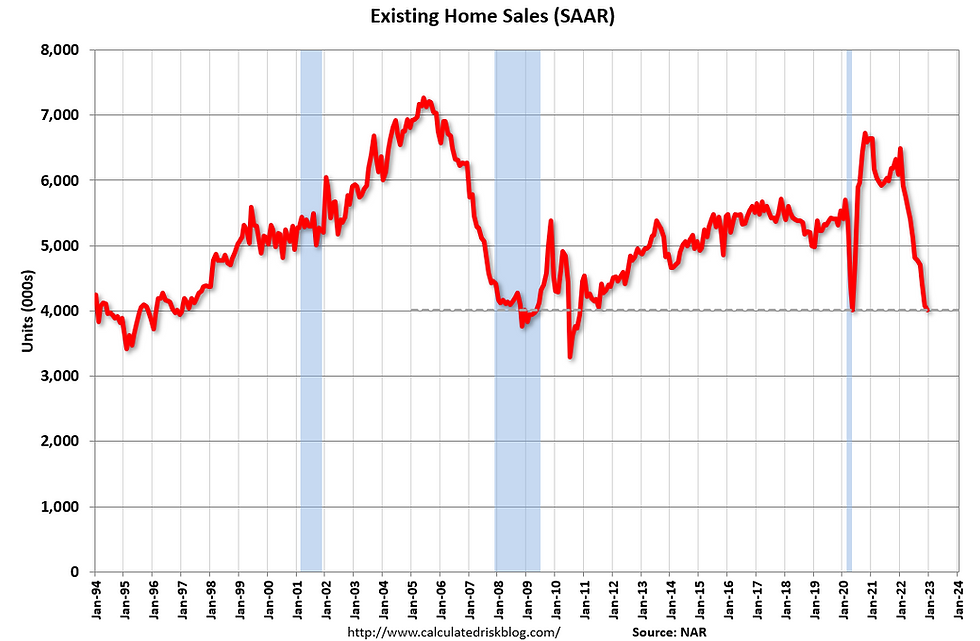

NAR: Existing-Home Sales Decreased to 4.02 million SAAR in December, Lowest Since 2010

- truth81

- Jan 22, 2023

- 3 min read

Updated: Jan 22, 2023

January 21, 2023

From the NAR: Existing-Home Sales Receded 1.5% in December

Existing-home sales retreated for the eleventh consecutive month in December, according to the National Association of Realtors®. Three of the four major U.S. regions recorded month-over-month drops, while sales in the West were unchanged. All regions experienced year-over-year declines. Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops – decreased 1.5% from November to a seasonally adjusted annual rate of 4.02 million in December. Year-over-year, sales sagged 34.0% (down from 6.09 million in December 2021).

... Total housing inventory registered at the end of December was 970,000 units, which was down 13.4% from November but up 10.2% from one year ago (880,000). Unsold inventory sits at a 2.9-month supply at the current sales pace, down from 3.3 months in November but up from 1.7 months in December 2021. emphasis added

The sales rate was above the consensus forecast.

Sales in December (4.02 million SAAR) were down 1.5% from the previous month and were 34.0% below the December 2021 sales rate. Sales were just above the pandemic low of 4.01 million SAAR. Other than the pandemic, this was the lowest sales rates since 2010.

Sales Year-over-Year and Not Seasonally Adjusted (NSA)

The second graph shows existing home sales by month for 2021 and 2022.

Sales declined 34.0% year-over-year compared to December 2021. This was the sixteenth consecutive month with sales down year-over-year. The NAR reports total existing home sales in 2022 were 5.03 million, down 17.8% from 6.12 million in 2021.

The third graph shows existing home sales for each month, Not Seasonally Adjusted (NSA), for a few selected periods. Black and light Purple are the maximum sales per month during the bubble (2005) and the minimum sales during the bust (2008 - 2011). The most recent four years are shown (2019 through 2022).

Sales NSA in December (327,000) were 36.3% below sales in December 2021 (513,000). On an NSA basis, sales were the lowest for December since 2008, and sales were only 7.2% above the record low for December in 2008.

This decrease in sales, NSA, was similar to change in the markets I track each month.

Housing Inventory Decreased in December

The fourth graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 0.97 million in December from 1.12 million in November.

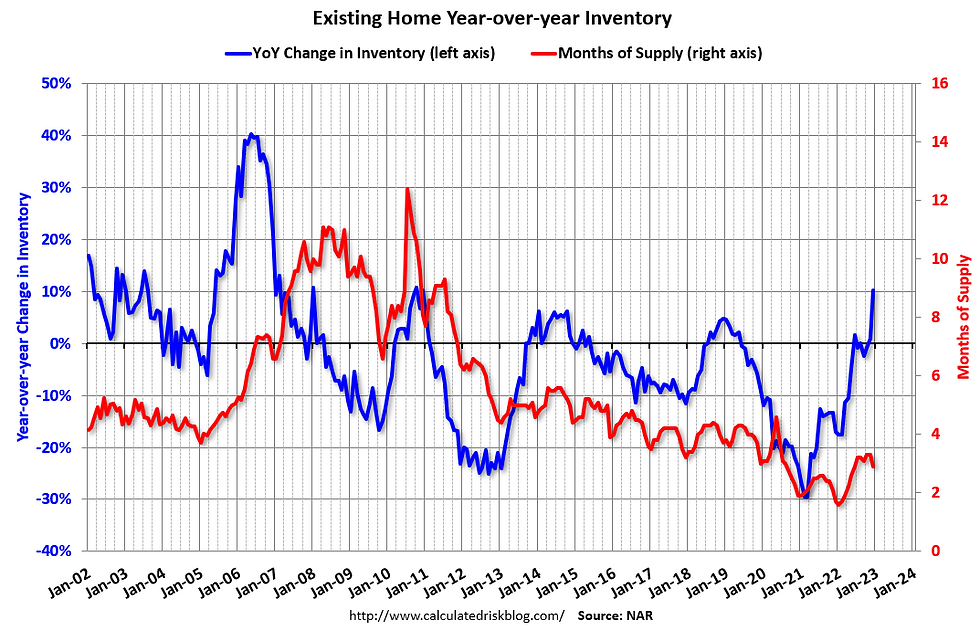

Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer. The fifth graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 10.2% year-over-year (blue) in December compared to December 2021. This includes some pending sales - and doesn’t match some other measures - and it seems likely that active inventory was up year-over-year much more in December than the NAR is reporting.

Months of supply (red) decreased to 2.9 months in December from 3.3 months in November.

Median House Prices

On prices, the NAR reported:

The median existing-home price for all housing types in December was $366,900, an increase of 2.3% from December 2021 ($358,800), as prices rose in all regions. This marks 130 consecutive months of year-over-year increases, the longest-running streak on record.

Median prices are distorted by the mix (repeat sales indexes like Case-Shiller and FHFA are probably better for measuring prices).

The YoY change in the median price peaked at 25.2% in May 2021 and has now slowed to 2.3%. The YoY increase in December was the lowest since May 2020. Note that the median price usually starts falling seasonally in July, so the 1.5% decline in December in the median price was partially seasonal, however the 11.3% decline in the median price over the last six months has been much larger than the usual seasonal decline.

It is likely the median price will be down year-over-year in a few months - and Case-Shiller will follow.

Existing home sales are reported when the sale closes. So, sales in December were mostly for contracts signed in October and November when mortgage rates peaked. Sales (seasonally adjusted) will likely rebound a little in January since mortgage rates declined somewhat in November and December. However, even with the recent decline in mortgage rates, rates are still double the rates in 2021 - and that impact affordability.

Comments