By Frank Holmes | US Global Investors

While most investors were fixated on Jerome Powell & Co. this week, trying to gauge the Federal Reserve’s next moves in light of recent bank failures, something interesting occurred in Moscow.

During a three-day state visit, Chinese President Xi Jinping held friendly talks with Russian President Vladimir Putin in a show of unity, as both countries increasingly seek to position themselves as leaders of what they call a “multipolar world order,” one that challenges U.S.-centric alliances and agreements.

Among those agreements is the petrodollar, which has been in place for over 50 years.

In case you’re wondering, “petrodollars” are not a real currency. They’re simply dollars being used to trade oil. Early in the 1970s, the U.S. government provided economic aid to Saudi Arabia, its chief oil-producing rival, in exchange for assurances that Riyadh would price its crude exports exclusively in the U.S. dollar. In 1975, other members of the Organization of Petroleum Exporting Countries (OPEC) followed suit, and the petrodollar was born.

This had the immediate effect of strengthening the U.S. dollar. Since countries around the world had to have dollars on hand in order to buy oil (and other key commodities such as gold, also priced in dollars), the greenback became the world’s reserve currency, a status formerly enjoyed by the British pound, French franc and Dutch guilder.

All things must come to an end, however. We may be witnessing the end of the petrodollar as more and more countries, including China and Russia, are agreeing to make settlements in currencies other than the U.S. dollar. This could have wide-ranging implications on not just a macro scale but also investment portfolios.

Dawn For The Petroyuan?

Putin couldn’t have been more explicit. During Xi’s state visit, he named the Chinese yuan as his favored currency to conduct trade in. Ever since Western sanctions were levied on the Eastern European country for its invasion of Ukraine early last year, Russia has increasingly depended on its southern neighbor to buy the oil other countries won’t touch.

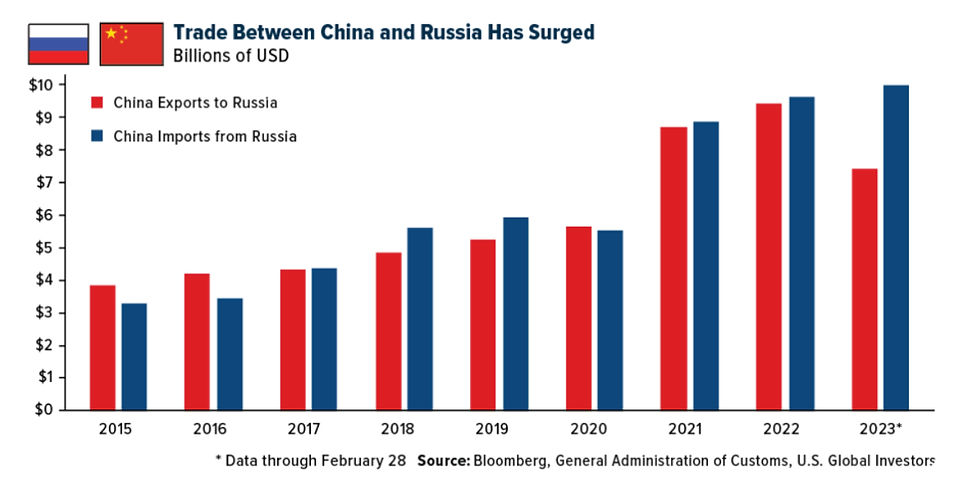

In just the first two months of 2023, China’s imports from Russia totaled $9.3 billion, exceeding full-year 2022 imports in dollar terms. In February alone, China imported over 2 million barrels of Russian crude, a new record high.

Except that now, the yuan is presumably being used to make these settlements.

As Zoltar Pozsar, New York-based economist and investment research director at Credit Suisse, put it recently: “That’s dusk for the petrodollar… and dawn for the petroyuan.”

U.S. Dollar Still The World’s Reserve Currency, But Its Dominance Is Slipping

Before you dismiss Pozsar’s comment as an exaggeration, consider that other major OPEC nations and BRICS members (Brazil, Russia, India, China and South Africa) are either accepting yuan already or strongly considering it. Russia, Iran and Venezuela account for about 40% of the world’s proven oilfields, and the three sell their oil in exchange for yuan. Turkey, Argentina, Indonesia and heavyweight oil producer Saudi Arabia have all applied for admittance into BRICS, while Egypt became a new member this week.

What this suggests is that the yuan’s role as a reserve currency will continue to strengthen, signifying a broader shift in the global power balance and potentially giving China a bigger hand with which to shape economic policies that affect us all.

To be clear, the U.S. dollar remains the world’s top reserve currency for now, though its share of global central banks’ official holdings has slipped in the past 20 years, from 72% in 2001 to just under 60% today. By contrast, the yuan’s share of official holdings has more than doubled since 2016. The Chinese currency accounted for about 2.8% of reserves as of September 2022.

Russia Diversifying Away From The Dollar By Loading Up On Gold

It’s not all about the yuan, of course. Gold has also increased as a foreign reserve, especially among emerging economies that seek to diversify away from the dollar.

This week, Russia announced that its bullion holdings jumped by approximately 1 million ounces over the past 12 months as its central bank loaded up on gold in the face of Western sanctions. The bank reported having nearly 75 million ounces at the end of February 2023, up from about 74 million a year earlier.

Long-Term Implications For Investors

The implications of the dollar potentially losing its status as the global reserve are numerous. Obviously, there may be currency risks, and a decrease in demand for U.S. Treasury bonds could result in rising interest rates. I would expect to see massive swings in commodity prices, especially oil prices, which could be an opportunity if you can stomach the volatility.

Gold would look exceptionally attractive, I think. A significant decrease in the relative value of the dollar would be supportive of the gold price, and I would be surprised not to see new highs. It’s for reasons like these that I always recommend a 10% weighting in gold, with 5% in physical bullion and the other 5% in high-quality gold mining equities. Be sure to rebalance at least on an annual basis.

Comments